Extension of 415z Limit also Extending to 415c Limit Bug Fix!

The Bug:

A bug caused a 403(b) age-based contribution limit extension to be incorrectly applied to 401(k) plans

- Intended Action: A patch was designed to extend contribution limits for 403(b) plans based on an employee's age.

- Unexpected Result: The same limit extension was incorrectly applied to 401(k) plans for employees also enrolled in a 415(c) plan.

- Impact: Affected employees were able to contribute beyond the legal 415(c) maximum for their 401(k) plan.

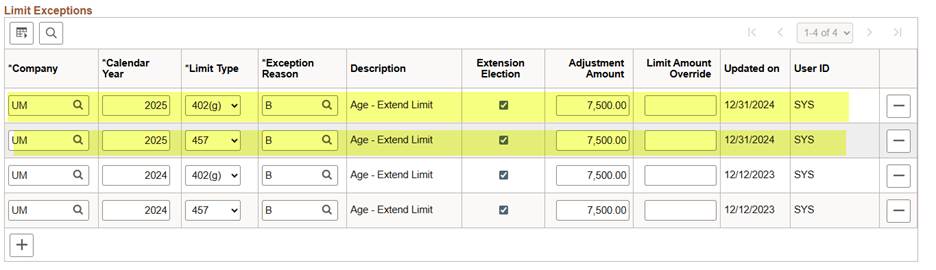

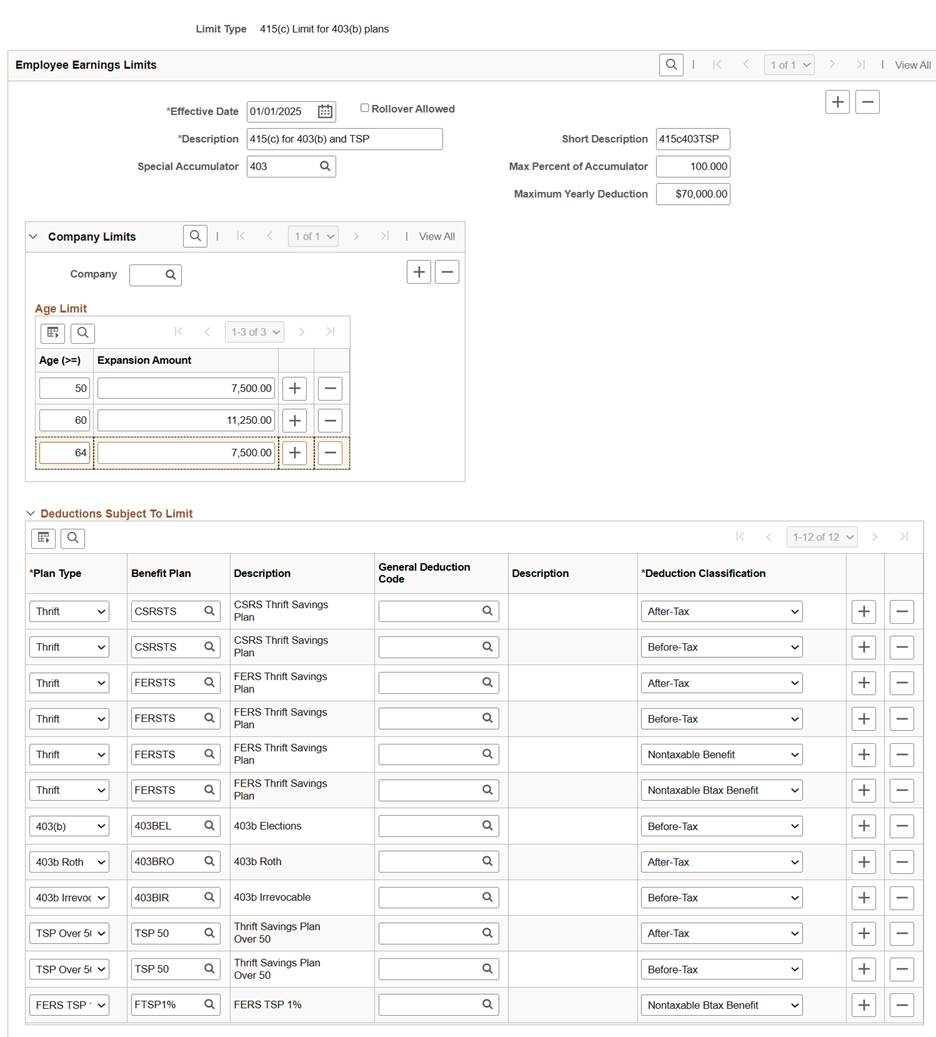

Image 52, Oracle released a bug fix to ensure that the 415(c) catch-up extension is applied only to the specific plan and not incorrectly extended to other plans.

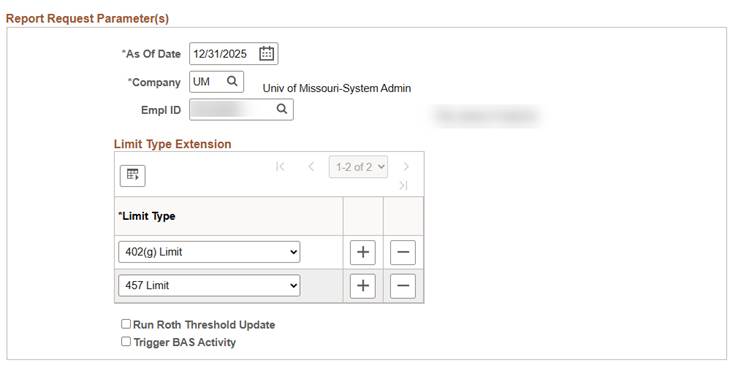

Pre Bug Fix:

Prior to the bug fix, Saving Age Catch Up Extension with 402(g) Limit and 457 Limit inserting two Age-Extend Limit rows on the Benefit Savings Management table.

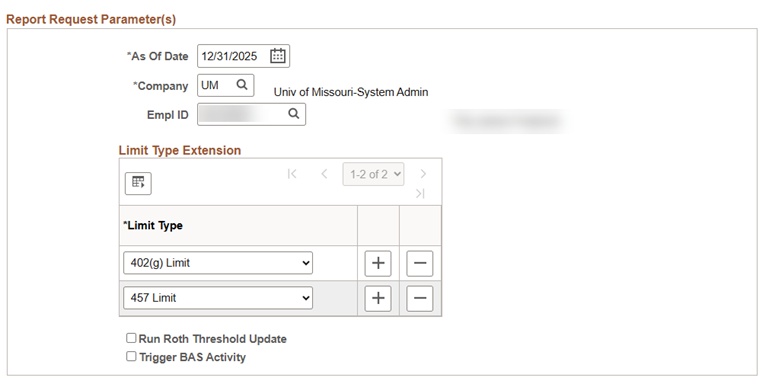

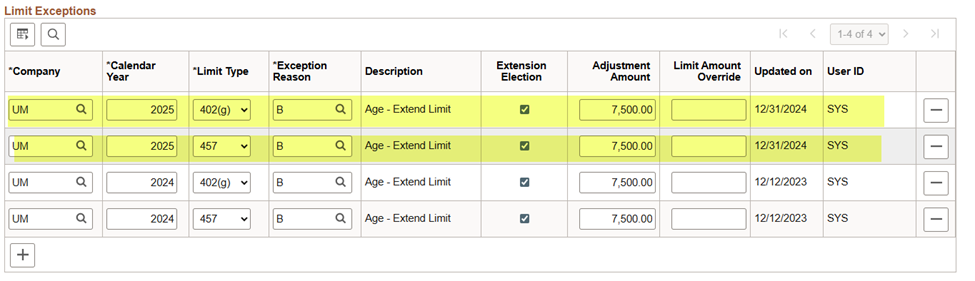

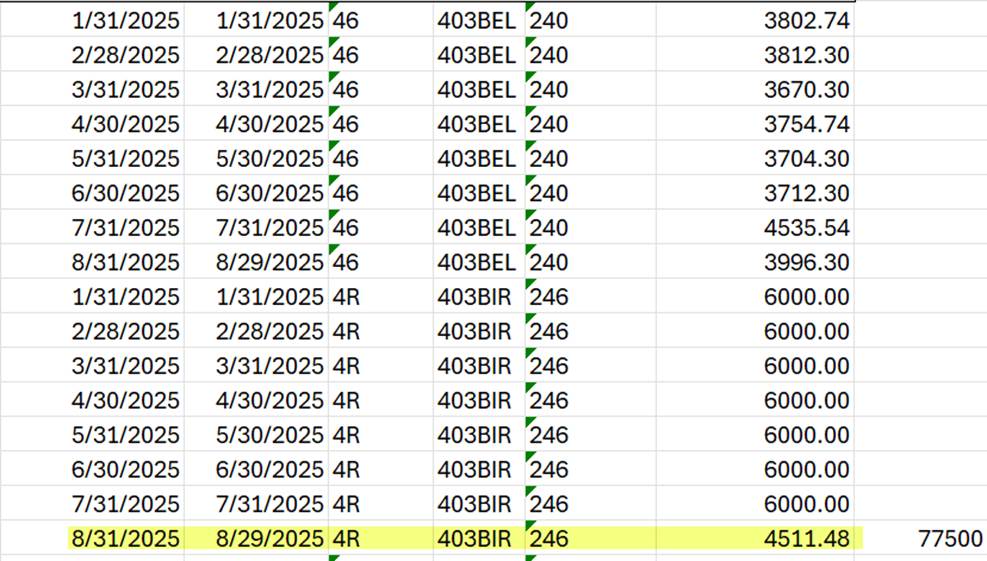

Test scenario after the bug fix.

Inserted the 415(c) Limit for 403(b) plans on the Savings Age Cath Up Extension, inserting the 415z Limit Type on the Benefit Savings Management table.

Employee’s age: 68 years old

The 403b Maximum Year Deduction: 70,000

Age Limit Extension: 7,500

Setup of Limit Type 415c Limit for 403b Plans

Suki Campbell

HRIS Specialist | Benefits and Retirement Programs

University of Missouri